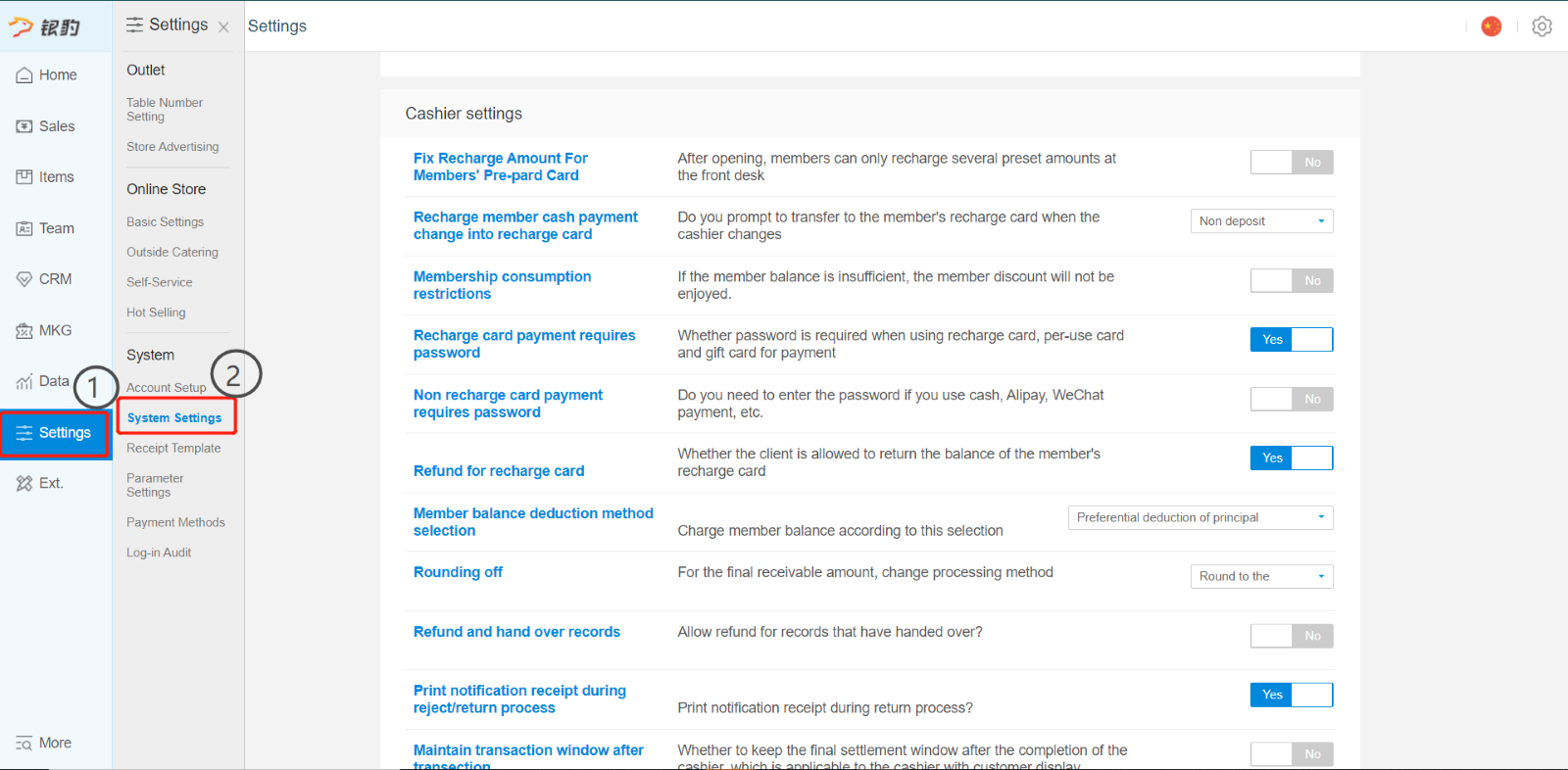

For GST and Service Charge, go to backend Settings>>System>>System Settings.

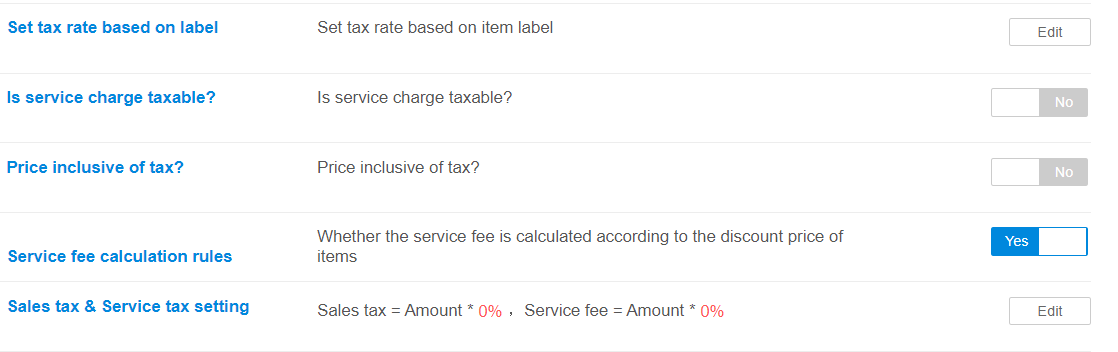

Scroll down to Sales Tax and service charge setting.

Click on edit to edit the amount.

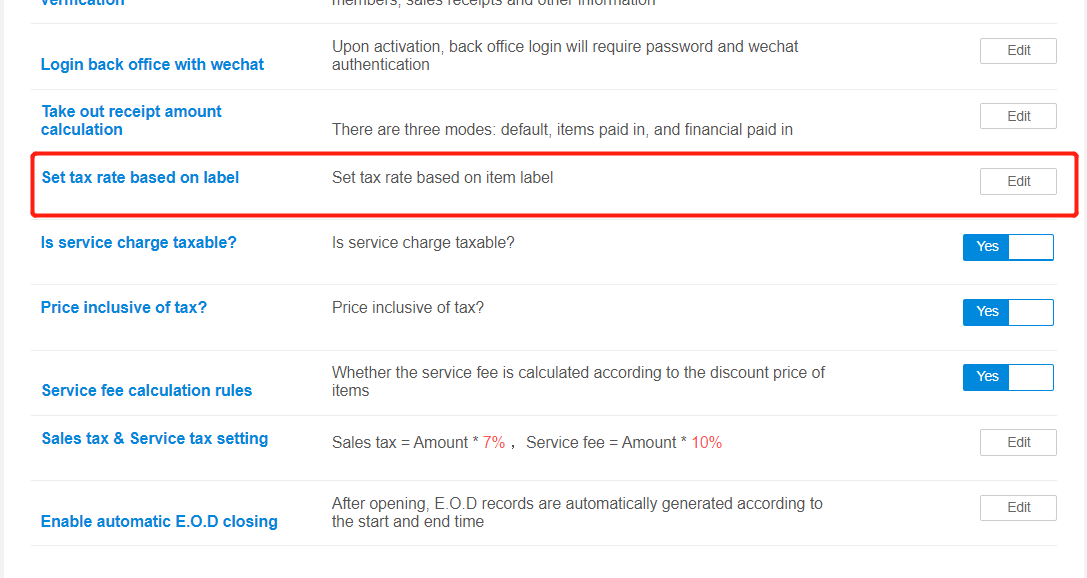

If GST and service charge are applicable, change sales tax to 7% and service charge to 10%.

If there are alcohol that does not have GST. You can set tax rate base on item label. Label the alcohol will a label and set zero tax rate for that label.

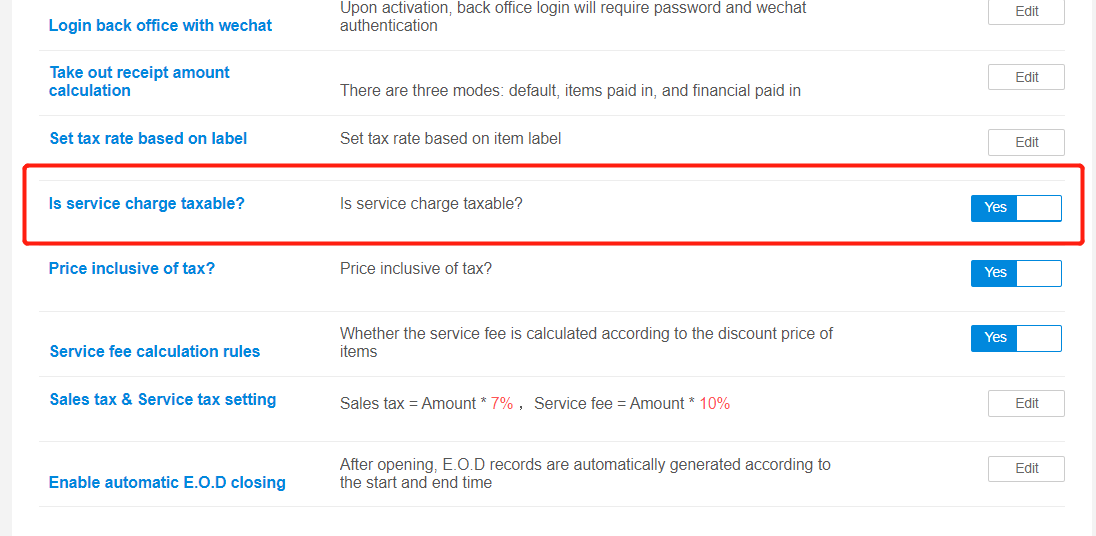

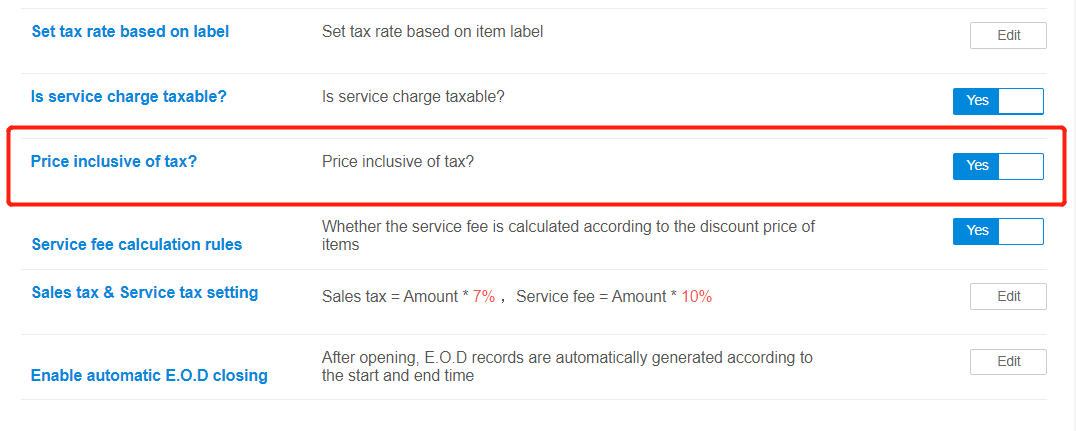

If service charge is taxable, activate service charge taxable.

If GST is price inclusive, activate price inclusive of tax. If exclusive, deactivate it.

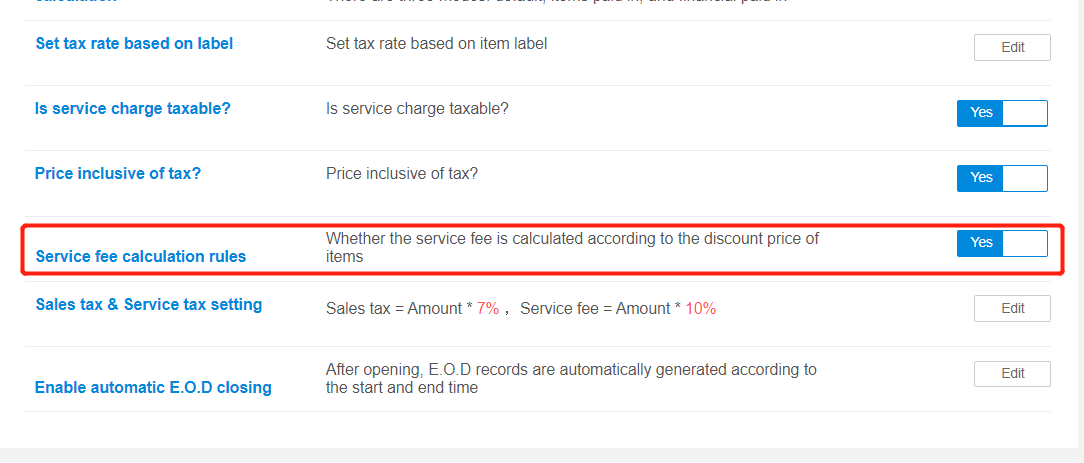

If the service charge will make calculation after the discount price, then activate service fee calculation rules.

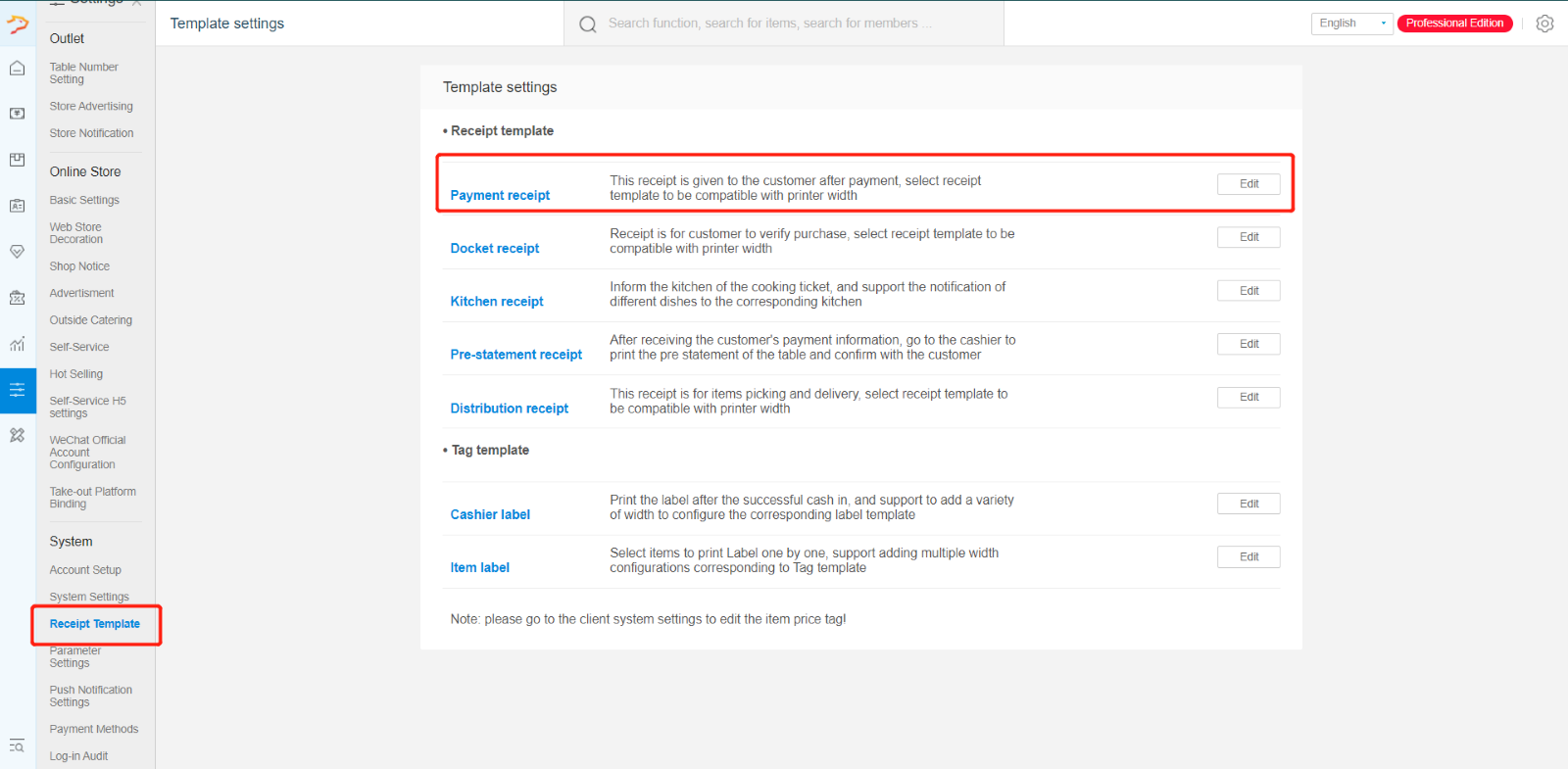

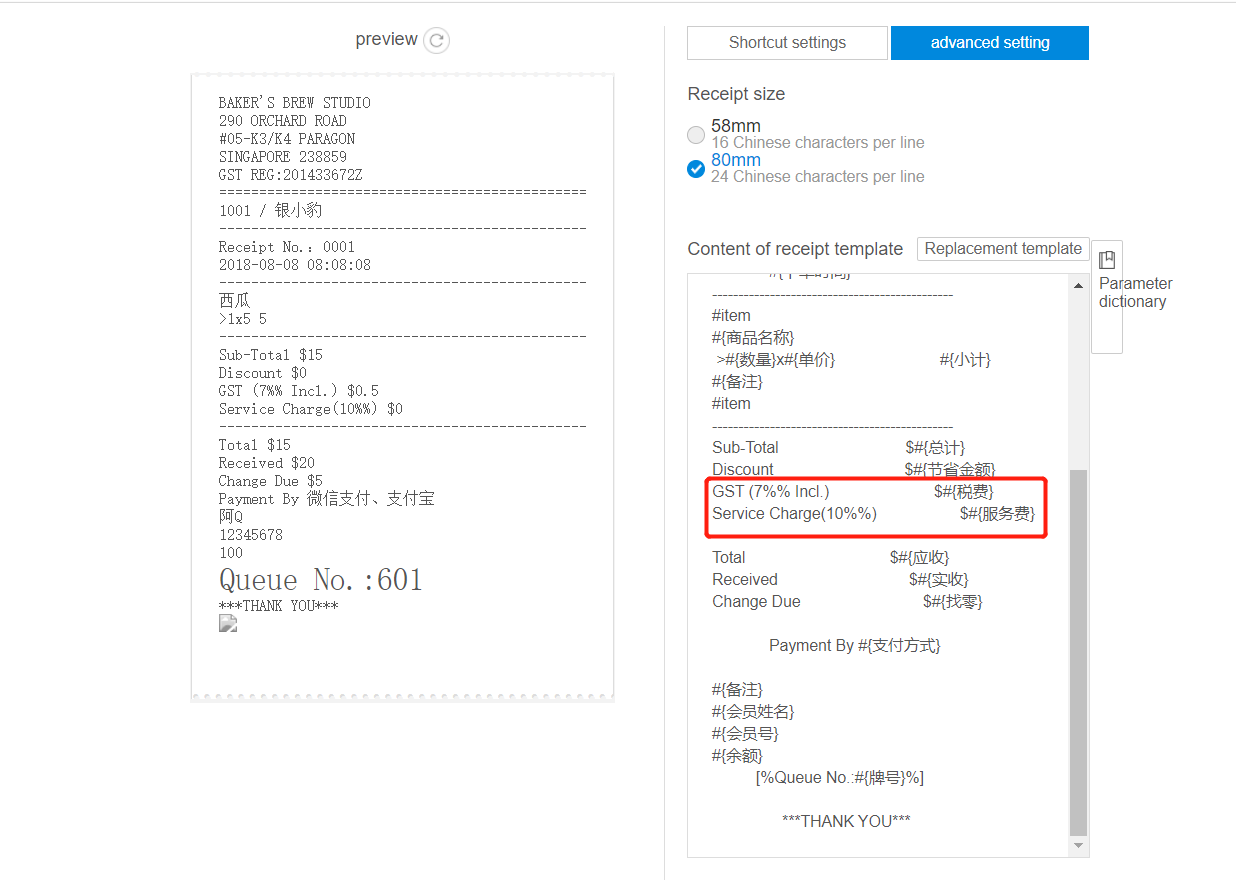

Remember to add in receipt template the parameter for GST and service charge:

GST: #{税费}

Service Charge: #{服务费}

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article